Patrick B. Wallace, President

Higher Strata Wealth Management, LLC

Many senior executives in the Aerospace & Defense Industry have spent their careers growing and managing the businesses for their shareholders and employees. Their busy, demanding jobs can often preclude them from devoting the same time and attention to their own personal financial situations.

The good news is that there are benefits to taking a thoughtful, systematic approach to addressing your financial challenges while continuing to serve your company.

To understand fully the specific business and personal financial challenges of this group, I conducted in-depth interviews with 13 individuals, including senior executives and related professionals in the Dallas Fort Worth area. I selected each for his or her ability to provide insights into the financial issues faced by these executives today.

Delving into the Work Place and Industry Challenges

The first series of questions asked were regarding the most pressing issues, concerns and problems that are facing the members of this community in their jobs. There were six themes I heard repeatedly and are given below:

Changing Defense Budgets. Administrations change every four or eight years and many times the priorities for defense spending change with the administration. This impacts the ability of government contractors to achieve their stated cost, schedule and performance metrics for any given program.

Attracting and Retaining Engineering Talent. Competition with the likes of Google, Apple and other high-tech companies is severe in the areas of compensation, work place environment, upward mobility and participation in the decision-making process.

Technology. The adoption of technology in government programs can be significantly behind that of the private sector due to an approval process that can take months and years for government certification.

Focus on Short Term Goals. In the mid 90’s, consolidation in the industry led to a sea change of the business model which measures executive performance based on quarterly scoring and compensation that includes Restricted Stock Units (RSUs) and stock options driven by quarterly profits.

High Stakes Programs. In 1979, the Sikorski UH-60 Black Hawk replaced the Bell UH-1 Iroquois as the Army’s tactical transport helicopter. Now, 40 years later, the Army is considering the Future Vertical Lift program to develop replacements for the Black Hawk and others. Losing a fly-off competition can mean significant loss of revenue for decades and this after many years of self-funding for development of new designs.

Long Hours. Work weeks can routinely be 60, 80 and up to 100 hours a week with some days completely consumed with back to back meetings and conference calls from 7:00am to 7:00pm leaving no time to get the “real” work done.

Delving into the Personal Financial Challenges

The second set of questions I asked were related to key financial challenges faced by this community. There were seven themes I heard repeatedly and are given below:

Complex Compensation Packages. Many top executives are compensated with a combination of salary, incentives, bonuses, stock options and a range of employee benefits. The complicated design of some of these packages may make it difficult for executives to fully understand and then maximize them.

Highly Concentrated Stock Positions. Given that many executives are compensated with company stock, it is not unusual for them to have a large portion of their net worth invested in a single stock. Some executives I spoke with expressed a desire to diversify their concentrated holdings but were unsure of how to do so in a tax-efficient manner.

Inadequate Retirement Planning. Despite their financial resources, some executives I spoke with have not implemented a long-term retirement plan. Many attributed their large company stock positions as a barrier in creating a diversified asset allocation strategy for retirement saving and income.

Lack of Financial Advice. Executives receive performance-based compensation from bonuses, stock options and RSUs, but are not given any advice on the best use of these large lump sum assets to help them achieve financial goals.

Pensions and Taxes. Many of the executives I spoke with are eligible to receive significant pensions beginning at age 55. If they chose to then “retire” from the company they have worked for over the last 30+ years and supplement their pension with consulting or other employment, there may or may not be any need to start withdrawals from their sizable 401K assets. Either way, there are significant tax implications. First, if they delay taking 401k withdrawals, they can only do so until age 70 ½ when Required Minimum Distributions (RMDs) kick in. This will significantly increase their taxable income and in some cases nearly double their tax liability. Second, if they chose to start taking 401k withdrawals immediately after retiring, then the IRS imposes a 10% penalty on top of ordinary income taxes due to “early withdrawals” before age 59 ½.

Timing of Social Security Benefits. Another aspect of early retirement is when to turn on Social Security benefits which can be done as early as age 62 or as late as age 70. In 2019, if someone who is younger than full retirement age and working, Social Security benefits will be reduced by $1 for every $2 earned above $17,640. There is no reduction after full retirement age. However, if the Social Security retirement benefit is delayed until the maximum age of 70, the benefit is increased 8% for every year after full retirement age.

Medical Costs. Choosing to retire early can also involve the loss of company medical insurance. Medicare does not start until age 65 and purchasing COBRA insurance is expensive and only available for 18 months in most cases. Purchasing individual medical insurance can also be very costly.

Work-Life Balance. Extremely long work weeks put a strain on family life and personal health from not having the time to eat right, exercise, or schedule doctor appointments for routine exams or illness.

Taking a Systematic Approach

While these issues can pose significant challenges for some executives, they can be system- atically addressed to help increase the likelihood of achieving their goals. Given their complex and varied financial needs, executives can consider using a wealth manage- ment approach. To define wealth management, I use this formula:

WM = IM + AP + RM

The first element of wealth management (WM) is investment management (IM). As I mentioned, this is the major focus of many financial advisors, and certainly astute investment management can be the foundation of executives’ ability to address their most important goals. However, my interviews revealed that many executives need more than just assistance in managing their investments. This is why I have the second element of wealth management, advanced planning (AP). Advanced planning addresses these four major areas of financial concern beyond investments:

- Wealth enhancement: mitigating tax burdens

- Wealth transfer: helping ensure that heirs are taken care of

- Wealth preservation: helping to protect loved ones and preserve assets

- Charitable giving: maximizing the impact of one’s charitable gifts

Since no one person can be an expert in each of these complex areas, wealth managers work closely with other professional advisors, such as CPAs, attorneys and insurance specialists, to address these issues. Depending on the preference of their clients, they may do this in conjunction with the clients’ current professional advisors.

This brings us to the third element of wealth management, relationship management (RM). To fully understand their clients’ most important goals, values and challenges—both now and long into the future—wealth managers must cultivate trusting, long-term consultative relationships with those clients.

Taken together, these three elements comprise a systematic approach that can help executives to make informed financial decisions for themselves and their families.

Not everyone wants to work with a financial advisor. If you do choose to work with a professional, consider one who uses the wealth management approach.

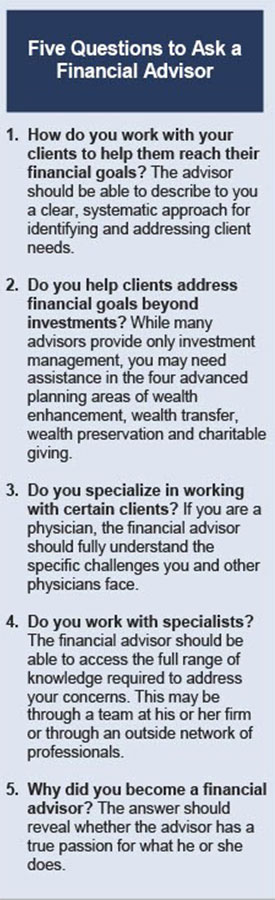

See the sidebar for questions that will help you determine whether a particular financial advisor is an appropriate choice for your situation.

A systematic approach—one that addresses their entire financial lives— can help to increase executives’ probabilities of achieving their most important goals.

Patrick B. Wallace is president of HIGHER STRATA WEALTH MANAGEMENT LLC. He may be reached at 817-591-1145 or pwallace@higherstrata.com.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Higher Strata Wealth Management, LLC and Cambridge are not affiliated.