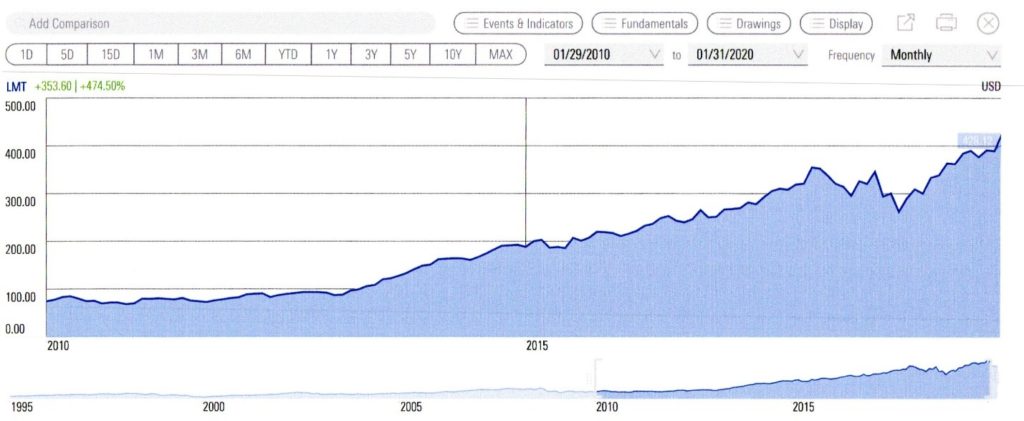

Morningstar chart: LMT 01/29/2010 to 01/31/2020

In the ten years between January 29, 2010 and January 31, 2020, Lockheed Martin stock has appreciated $353.60/share for an amazing cumulative gain of 474.50% according to Morningstar. Anyone participating in the 401(k) plan over that time could be sitting on a hefty gain on the LMT stock contributed either by Lockheed Martin for the employer match portion or shares purchased by the employee. That’s the good news.

The bad news is taxes will be paid on that sizable gain, but you have a choice. The gain can be taxed at ordinary income rates or lower long-term capital gain rates using Net Unrealized Appreciation (NUA).

- How NUA Works

- Option 1: Rollover to IRA

- Option 2: Transfer to Taxable Account

- Option 3: Do Both

- Requirements

- Your Mileage May Vary

How NUA Works

This is how it works. If the LMT stock inside the 401(k) is rolled over to an IRA, both the cost basis and the capital appreciation will be taxed as ordinary income as it is distributed from the IRA. However, if the LMT stock is transferred in-kind to a taxable account, only the cost basis of the stock is taxed as income. Then, when the stock is sold in the taxable account, the Net Unrealized Appreciation (gain) is taxed as a long-term capital gain.

To illustrate, we will look at a very simple example where a 60 year old Lockheed Martin employee decides to retire and rollover their $1,000,000 401(k) to an IRA and then convert the LMT stock portion to a Roth IRA to diversify their concentrated stock position and help reduce future taxes. Or, transfer LMT to a taxable account and diversify. The LMT stock held inside the 401(k) has a market value of $100,000 with a $25,000 cost basis.

Option 1: Rollover to IRA

On the initial rollover to the IRA, there will be no taxes due. However, when the LMT stock is sold and then converted to a Roth IRA, the entire $100,000 is subject to ordinary income tax. The additional $100,000 of income could easily bump the employee into the next higher tax bracket (assume 34%) for that year and they will end up writing a check to Uncle Sam for $32,000 leaving just $68,000 for the Roth IRA. By the way, the IRS will not write you a Thank You note for your generous contribution because they think it is their money you have been hording all these years.

Option 2: Transfer to Taxable Account

On the other hand, if the LMT stock is first transferred to a taxable account and then sold and re-invested for diversification, the taxes paid are much less leaving more to invest. First, assuming the $25,000 of additional income does not bump them into the next tax bracket, the income tax on the cost basis of $25,000 assuming a 24% rate will be $6,000. Next, long-term capital gain tax on the remaining $75,000 will be $11,250 at 15% for a total tax bill of $17,250 (45.3% less) leaving $82,750 (21.7% more) to re-invest in the taxable account.

Option 3: Do Both

Deciding whether to take advantage of this strategy will depend on the cost basis of the LMT stock inside the 401(k). Shares purchased before May 2003 were below $100 and went up from there. Therefore, it may be necessary to pick only the shares with the lowest cost basis for the NUA distribution to produce the desired tax outcome. Fortunately, the rules will allow NUA treatment of a portion of shares taken in-kind and the rest can be rolled over into an IRA.

Requirements

If, after you, your financial advisor and your CPA decide that NUA makes sense, there are three very specific requirements that must be met:

- The employer stock must be distributed in-kind to a taxable account. This means the actual shares that are held in the 401(k) must be transferred to the new taxable account. You cannot sell the shares in the 401(k), transfer the cash and then repurchase shares in the new account.

Also, and very important, if the shares are rolled over to an IRA first, they cannot then be transferred to a taxable account and receive NUA treatment. The IRS considers this a gift from above taxable distribution and it will be taxed as ordinary income.

- The employer plan must make a “lump sum distribution”. This doesn’t mean just the LMT stock needs to be taken out; it means the entire retirement account must be distributed in a single tax year.

- The lump-sum distribution must be made after a “triggering event”. There are four triggering events that will allow an in-kind lump sum distribution for employer stock to receive NUA treatment. They are Death, Disability, Separation from Service and Reaching Age 59 ½.

Your Mileage May Vary

NUA is not a guaranteed tax savings strategy. The trade off between the upfront tax hit, which is very dependent on cost basis, when transferred to a taxable account and the ability to defer taxes if rolled over to an IRA along with the added consideration of how long do you want to keep the stock.

Would NUA provide a benefit for you? It depends. If you would like a second opinion on how this strategy could help you reach your goals, please consider our complimentary Second Opinion Service to get a different point of view and evaluate your options.