Source: New Old Stock

Source: New Old Stock

With the recent market losses, current low tax rates and extended age for Required Minimum Distributions (RMDs), now maybe a “Sweet Spot” for Lockheed Martin retirees whose RMDs have not yet kicked in. By making systematic Roth IRA conversions, these retirees can minimize their taxable rollover IRAs and build substantial Roth IRAs with tax free distributions for them and their beneficiaries.

- Advantage of Roth Conversions

- Lockheed Martin Retiree with Traditional Rollover IRA Only

- The SECURE Act and Non-Spousal Inherited IRAs

- Lockheed Martin Retiree Using Roth IRA Conversions

- Conclusion

Advantage of Roth Conversions

Since 2010, taxpayers have had the ability to convert traditional IRA accounts to Roth IRA accounts without any minimum or maximum limits. The advantage to the taxpayer is that future distributions are tax free from a Roth IRA whereas they are taxable from a traditional IRA. The downside is that the full amount of the conversion is reported as income in the year that it is made and for the conversion to be beneficial, the tax rate at time of conversion needs to be the same or lower than the marginal tax rate in the future.

To better understand this, let’s look at the marginal tax rates today for a retired couple with combined taxable income of $180,000 which puts them in the 24% bracket. The range of income for this rate is between $171,051 and $326,600. If they wanted to do a partial Roth IRA conversion, they could convert up to $146,600 ($326,600 – $180,000) of their rollover IRA without bumping up to the next marginal rate at 32%. So, the trick is to “fill up” the tax bracket each year and stay within the total desired income range.

Lockheed Martin Retiree with Traditional Rollover IRA Only

To illustrate, let’s assume the couple above has just retired from a long and successful career at Lockheed. They are both 60 with life expectancies of 90 and they are living comfortably on the $180,000 of combined income from their pensions. Combined traditional rollover IRAs are worth $2,000,000 with a 7% growth rate. In addition to their IRAs, they have accumulated a $300,000 brokerage account from their Deferred Management Incentive Compensation Plan (DMICP) and Restricted Stock Units (RSUs). They will begin taking combined Social Security retirement benefits of $5,000 monthly at age 70. We will also assume future tax rates do not go up…LOL.

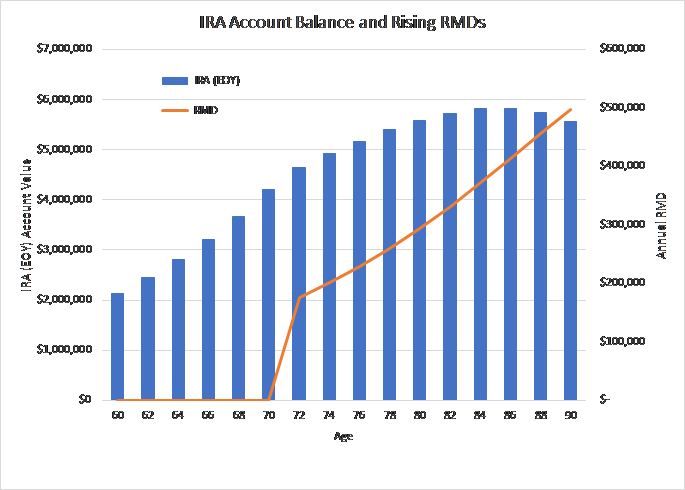

Since the passage of the SECURE Act last December, Required Minimum Distributions (RMDs) now begin at age 72, up from age 70 ½ . So, in 12 years their rollover IRAs will have grown to $4,504,381 and their first RMD will be $175,952. Combine this with their $180,000 in pensions and $60,000 in Social Security benefits and their total income nearly doubles in one year from $240,000 to $415,952 raising their marginal tax rate from 24% to 35% increasing their tax liability by a whopping 133% from $38,468 to $88,521. And on top of that, their annual Medicare Part B premiums go up 60% from $6,940.80 to $11,104.80.

By the time they are 90, their annual RMD will increase to $497,135 putting them in today’s highest tax bracket of 37% and the maximum annual Medicare Part B premiums of $11,798.40. The ending value of their rollover IRA will be $5,566,912 which they will leave to their adult children who will be eternally thankful and live happily ever after, but not so fast.

The SECURE Act and Non-Spousal Inherited IRAs

Now due to the SECURE Act, their children must withdraw the entire amount of their inherited IRAs within 10 years and can no longer “stretch” the distributions over their life expectancies. Most likely, their children will be in their peak earning years during this time and the additional income will place them in a much higher tax bracket losing a significant amount of their inheritance to income taxes.

Lockheed Martin Retiree Using Roth IRA Conversions

Fortunately for this couple, before they retired, they met with their wealth advisor, a CERTIFIED FINANCIAL PLANNER®, who helped them design an alternate strategy that significantly reduced their taxable RMDs by almost half and nearly doubled the ending balance of their retirement accounts allowing their children to receive not only a dramatically larger inheritance, but to receive nearly two thirds of it tax free. Sound too good to be true? Let’s see.

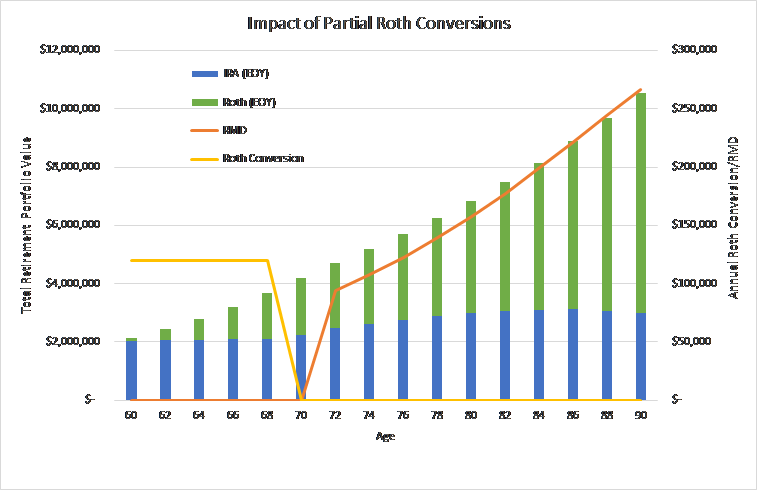

Their wealth advisor recommended annual partial Roth IRA conversions of $120,000 for 10 years beginning their first year of retirement and ending at age 70 when their Social Security benefits begin. Taxes on the Roth IRA conversions will be paid out of their brokerage account. During these 10 years their annual total taxable income will be $300,000 ($180,000 + $120,000) and within the income range of the 24% marginal tax bracket.

By the time their RMDs begin, they have successfully limited their overall IRA exposure by minimizing the growth of their taxable rollover IRA to less than $2.5 million and at the same time will have accumulated a tax-free Roth IRA worth over $2.2 million assuming a 7% annual rate of return.

At the end of their lives, the rollover IRA is projected to be less than $3 million while the Roth IRA will have grown to almost $7.6 million. Their children will receive a total inheritance of over $10.5 million, nearly double the amount in the first example. But, while both IRAs will still need to be fully distributed within 10 years, the inherited rollover IRA could be drawn down annually over that time to minimize taxes while the Roth IRA could continue to grow tax free for 10 years with a single lump sum tax free distribution of nearly $14.9 million!

CONCLUSION

By doing systematic partial Roth IRA conversions in the years between retirement and the beginning of RMDs at age 72, it is possible to reduce the size of your taxable RMDs and create a significant tax free retirement account to dramatically increase total retirement assets that can then be left to your beneficiaries in a very tax efficient manner.

With the recent market losses, current low tax rate and extended age for RMDs, this maybe a “Sweet Spot” for many Lockheed Martin retirees to make Roth IRA conversions. Will this work as well for you? I don’t know but we can certainly help you find out with our complimentary Second Opinion Service. Give us a call today or Click Here to contact us!

Patrick Wallace is President of HIGHER STRATA WEALTH MANAGEMENT, www.higherstrata.com.

He may be reached at 817-591-1145 or pwallace@higherstrata.com.

Examples are hypothetical and for illustrative purposes only. The rates of return do not represent any actual investment and cannot be guaranteed. Any investment involves potential loss of principal.